Q3 Results: How’s Microsoft doing in its cloud and mobile transition?

Following Microsoft'south Q3 FY2014 earnings written report from last night I thought nosotros should take a await at the large picture behind the numbers and address some of the key themes from the company'due south analyst conference phone call (which you lot tin can find here)

Let's have a quick look at the numbers for Q3. Revenue was $twenty.4 billion, gross profit was $14.five billion and operating income was $7.0 billion. While adjusted revenue grew 8%, earnings per share (which came in at $0.68) grew slightly less at 5%.

Conspicuously Microsoft is not in whatever kind of financial trouble. I say this despite not exactly being a Microsoft fan. I ain and use exactly nada of their products so I'm simply looking at the business as a engineering science investor here. Microsoft is growing slowly. No, they're not even growing equally fast as Apple and they certainly are not growing anywhere shut to as fast as deeply mobile companies like Facebook. But they're growing and are on very strong financial ground.

What makes Microsoft unique is its deeply entrenched position into the market. They're also making progress shifting the concern model to align with their new "cloud commencement, mobile first" mantra. Yes, I know the phrase is already getting tiring, just I think it says a lot well-nigh what the PC giant is doing and what they've admitted to themselves.

What have they admitted? I retrieve they know that Apple and Android have the mobile hardware and operating systems pretty well locked up at this betoken. Information technology's a very tough uphill climb for anyone to compete, including Microsoft. And because the desktop / notebook market will exist deeply affected by mobile trends, the Windows OS franchise is not as valuable as information technology once was.

The solution? Move business concern It functions into the cloud and support them from any device whether information technology runs Windows, Android or iOS. Sell subscriptions to deject-based software like Office 365 rather than old licenses for Microsoft Office installed on Windows boxes. Sell the infrastructure to build apps in the Azure cloud instead of selling server boxes. Permit corporate clients to downsize their Information technology departments and pay role of the former equipment and staffing neb to Microsoft instead.

The migration of Microsoft to this new cloud and mobile model is in its very early days, to be clear. The "Commercial Other" line, where all cloud revenue falls, amounted to $one.9 billion, or less than 10% of total visitor sales in the last quarter. But the big pieces (Azure and Office 365) both grew at least 100%, so by this time next year it's possible Microsoft could be significantly further along in its transformation.

One year ago I was very bearish on Microsoft. I felt they had no take chances of beingness a #1 or #two in the mobile platform wars, which would injure them compared to theoretical globe where Windows Mobile was the dominant operating system. But I neglected to consider just how powerful Microsoft is with its large enterprise customer base. These are businesses that (more often than not) move quite slowly when it comes to IT strategy. So Microsoft just needs to move faster than its customers demand them to, which I think is happening.

Microsoft is highly profitable and last night they reported $88 billion of cash offset partly by $21 billion of long term debt. They are well equipped, financially, to transform themselves over the next decade. At the end of that decade, it's possible many of its large customers may not use Windows anymore. But if they still use Role (in the cloud) and run enterprise apps via Azure, then Microsoft should brand out like a bandit. However, I'm all the same keeping my eyes open to the possibility of Amazon, Google and others accelerating their competitive efforts against Microsoft.

What's your take? Practise y'all retrieve I'm too concerned about Windows marketplace share erosion? Or maybe I'chiliad not existence ambitious enough in describing the risk? What do you think the likelihood is that Nadella's team tin radically transform an one-time-world computing company into a deject and mobile leader? Is it reasonable to pay 14x adjacent year's earnings for Microsoft at this bespeak in the turnaround when you consider the risks? Drop u.s. a comment.

(Chris Umiastowski is a contributing financial writer to the Mobile Nations network. You can see the rest of his posts hither at

We may earn a committee for purchases using our links. Acquire more.

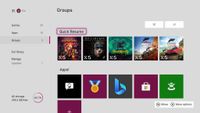

Xbox Insiders Update

This huge Xbox 'Quick Resume' update will give gamers more command

Microsoft is adding a new feature to Xbox consoles, allowing you to permanently store up to two games in a Quick Resume country at all times. The feature is heading out first to Xbox Insiders in the Alpha testing band before hitting the general public.

Solid Foundations

ASUS ROG Strix X570-Eastward is the all-time motherboard for Ryzen 9 5900X

The motherboard can bear witness a approval or a hindrance when used with high-functioning processors like the AMD Ryzen 9 5900X, depending on which you become for. We've rounded up the best B550 and X570 motherboards that are compatible with the new Ryzen processor.

Source: https://www.windowscentral.com/q3-results-hows-microsoft-doing-cloud-and-mobile-transition

Posted by: sauermazint.blogspot.com

0 Response to "Q3 Results: How’s Microsoft doing in its cloud and mobile transition?"

Post a Comment